Traditionally, a central authority issues currency that powers our economy and is used by any exchange, such as the government and the banks. They, therefore, have the power to manage and regulate the flow and supply of that currency in the market. We also move over ownership of our holdings to other financial institutions and deposit in banks in hopes of better returns. The main concern with this is distribution is the control of funds by a centralization body. Decentralization is the solution to this. In this guide we will get complete understanding of Defi.

What Is DeFi ?

DeFi is Decentralized Finance.

- The main Goal of DeFi is to provide an open and transparent finance. It covers digital currencies, protocols, smart contracts, and blockchain-based applications. Cutting middlemen out of Defi is one of the key benefits. The mission is to allow full ownership of assets.

- It is an open financial environment in which a variety of small financial capital and services can be established in a decentralized manner. As these applications are built on a particular blockchain, they can be combined, updated, and integrated to fulfill requirements.

- While many new-age banks and fintech firms are committed to allowing customers to have more power, we must trust them to control the funds.

- Many financial software developers often follow open-source trading protocols across decentralized exchanges. The fact that all protocols are open-source allows one to develop new financial products and Developers across the globe can work together to create new products that can lead to rapid development and a stable network. Ethereum Network is the main choice for Defi projects.

- Anyone can easily deposit, share, and spend their money in blockchain and make a lot better return than the traditional financial system.

Top Five Features Of Defi

1. Transparent

The code for these financial applications is available to all to access and analyze. This is vital so everyone can check how apps and protocols operate and watch where the funds are.

2. Globally Available

There are no boundaries and anyone will have access to it like the Internet.

3. Complete Ownership

It helps individuals to have power of their own money and data and to move value from one entity to another without the need to use middlemen such as banks and financial institutions. People are the only ones to keep the keys to their accounts and manage their money.

4. Financial Lego

Developers will now build on other applications which will drive creativity and create these applications to become more like lego pieces, exploiting each other's utility.

5. Decentralization

Blockchains are operated by thousands of nodes scattered across the world, causing it nearly difficult to censor or stop them. DeFi systems are intended to be run by an users community . Users become owners of their financial applications; they are able to take part in big decisions, including by making improvements themselves, and to benefit from their development and performance.

Limitations

Lack of basic understanding

Basic understanding of blockchain is required for the safe management of cryptocurrencies and financial instruments, and of course a risk factor is involved. It is the duty of a user to keep his keys safe.

Smart Contract Security

In June 2016, the DAO hack occurred. During the incident, one-third of DAO funds have been moved to another account by using a coding weakness. This forced the Ethereum community to hard fork the blockchain in order to recover capital. Since then, the security of the DApp and Smart contracts has increased significantly, but it is reckless to take this for granted. Security audits were carried out by some DeFi tools, such as four security audits received so far by Dai. In addition, companies such as Nexus Mutual have taken the initiative to develop insurance to cover such problems as the collapse of smart contracts.

It is important that every project should be audited befor launch and keep getting intermittent audit to avoid any vulnerability.

Change in Policy

As a DeFi customer, you need to stay up-to-date with changing service terms between different DeFi products, wallets, exchanges and crypto projects. Some DeFi products may add new parameters coupled with protocol or platform-based DAOs.

Relatively new concept

As with traditional money market, potential investors use historical information and benchmarks such as annual currency inflation and the risk-free return on investment to assess investment opportunities. However, in the DeFi, it is difficult to determine the probability of investment in DeFi because of the lack of detailed historical evidence and benchmarks.

An Introduction To Popular DeFi Projects

There can be multiple metrics to major the success of a project but sometimes it becomes challenging to identifiy a project in the very begining to support. Below are some popular DeFi projcets on Ethereum.

MakerDAO

MakerDAO is an Ethereum based protocol which is recognized for being the first stablecoins-focused DeFi platform. It was introduced in 2015 and helps users to borrow Stablecoin Dai and aims to keep prices of Dai pegged to the US Dollar. Dai is a crypto-collateralized asset, which means that any crypto must be leveraged and tied up as collateral. This process effectively enabled anybody to borrow the Dai stablecoin from Ether (Ethereum's native cryptocurrency). It provided a way for everyone to borrow without relying on a single body.

Compound Finance

In June 2020, Compound Finance began rewarding lenders and borrowers with cryptocurrencies on its network with, in addition to traditional interest fees to lenders, new cryptocurrency units known as the COMP token, which is used for the administration of Compound's platform yet is also tradeable on exchanges. The network is available to anyone, anywhere in the world to be used and computer code instantly executes financial contracts. Securing loans do not depend on the credit score or the income and liabilities of the person, but on the assets, they deposit in the system to cover the value of the loan; in short, loans in Compound are over-collateralized. It allows loans to be permissionless and fully automated. If the collateral falls below the ratio required, the funds are liquidated.

Uniswap

Uniswap is an automated token exchange protocol for Ethereum. It was released on 2 November 2018. The automated market maker (AMM) model depends on liquidity pools in which each token is matched with ETH, meaning that there is still adequate liquidity for any two tokens. It is an open protocol for all to use. All traders need to start exchanging tokens with an Ethereum account.

Anyone is also free to provide liquidity to these pools of tokens in return for trading costs in proportion to their share of the liquidity of the pool. Liquidity providers can add or remove their funds at any time. Uniswap does not have a native token, but liquidity providers get tokens that reflect their share of the pool.

When introduced, Uniswap was a decentralized exchange designed on Ethereum to swap ERC20 tokens. Unlike standard centralized exchanges that can easily be controlled and exploited by governments or other third parties.

The potential of idea of Decentralized exchanges was powerful enough. As a result at that time, Uniswap with just around 10 employees overtook the number of transaction on Coinbase which is one of the biggest centralized exchanges in the market and has more than 1,000 employees.

Uniswap is over 2 years of continuous growth, bug fixing, and is growing at a very fast pace.

The launch of Uniswap Governance token (UNI) on 16 September 2020, witnessed one of the most reputable and decentralized transfers of tokens ever. Any user who used Uniswap before 1 September, 2020 was entitled to receive 400 UNI tokens worth $1200 on the day of the launch, a huge payday for all previous Uniswap users.

Why Most DeFi Projects Use Ethereum ?

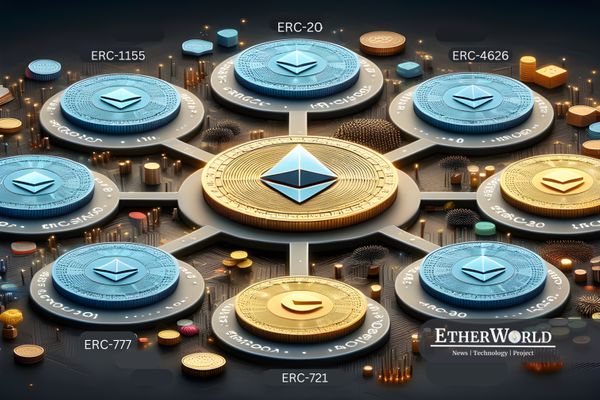

Ethereum is the leading blockchain that supports DeFi projects. It is the default choice of any developer because of multiple reasons:

-

Ease of deploying application: That's because Ethereum's smart contract platform which immediately executes contracts if certain requirements are met,offering a lot of stability. Solidity Programming Language was specifically developed to build and deploy such Smart Contracts.

With smart contracts at the heart, hundreds of Defi apps are running on Ethereum. -

Availability of standards: With the avalibility of multiple standards on Ethereum blockchain, it is easier for a dApp developer to create a new project with a new concept.

-

Supporting infrastructure: Ethereum blockchain is supported by many tools & projcets. It becomes easier for a project developer to deploy a projcet with a focus on the core idea and rest being supported by the infra available.

One of the biggest problem scalability is needed for the main stream adaption of the DeFi apps. It is expected that Ethereum 2.0 willimprove these applications by chipping away Ethereum's scalability problems. However, since the implementation of sharding in Ethereum 2.0 is a few upgrades down, L2 projects proven to be helping a lot.

How Defi is different than Fintech

What is Fintech?

Fintech seeks to use technologies to develop and improve current financial services. It's about building on largely proprietary applications. The software and its implementation are fully trusted and censorable. The final payment layer for fintech transactions is not a code. There is always a bureaucrat. There is no cryptographically assured immutability of transactions, and the whole system is built on massive political risk, and applications are continually at risk of being de-platformed.

Key Differences

- Fintech is actually expanding on existing financial infrastructure, instead of using anything new like blockchain technology.

- Transferwise, an international payment app, will be an example of a successful Fintech service. While Transferwise charges lower fees than other banks and foreign exchange firms, it also uses bank accounts and other legacy financial infrastructure.

The distinction with Transferwise is that, instead of transferring money around borders and via other intermediaries (like banks), Transferwise has bank accounts in various countries.

When senders send USD to someone in the European Union, Transferwise takes dollars and then takes money from the EU bank account to give it to the recipient. This helps them to charge lower rates and to handle purchases more efficiently.However, we do need to trust Transferwise to authorize and clear up the transaction. In addition, we also have to get approval to send money overseas. In most cases,identity verification is needed to transfer money to the recipient if they are based in a blacklisted country. - Now contrast this with the DeFi product, Dai, an Ethereum-based stablecoin intended to mimic the valuation of the US dollar in order to protect against the wild fluctuations that cryptocurrencies are known to cause. With Dai, you do not have to trust Fintech or the bank to accept and settle your transaction. Instead, Ethereum miners verify and link new Ethereum-based transactions, including those of Dai, to the blockchain.

These miners can handle the transaction as long as it contains a small charge of about a few cents in USD. This also occurs in less than 20 seconds instead of days, as in traditional financial infrastructure. Senders can send Dai to anybody with a wallet that supports Dai, even though they reside in countries blocked from the traditional financial system.

Conclusion

Decentralized Finance (DeFi) is a concept that utilizes decentralized networks to turn old financial services into fully decentralized and transparent procedures without middlemen. The DeFi market is limited relative to conventional finance, but has grown steadily since last year. With more ventures and financial dApps, we would hope to enter a fully transparent financial reality where the conventional finance industry integrates perfectly with digital assets and blockchain. A few years after MakerDAO put the first financial lego, there are now hundreds of DeFi apps, from simple use-cases like lending, investing, selling, to crazier ones like making synthetic cash, broadcasting transfers, and playing in a lottery where you will still get your money back.

Resources: Trust Wallet, Exodus, CoinMarketCap, Coindesk

________________________________________________________Disclaimer: The information contained on this web page is for education purpose only. Readers are suggested to conduct their own research, review, analyze and verify the content before relying on them.

To publish press releases, project updates and guest posts with us, please email at contact@etherworld.co.

Subscribe to EtherWorld YouTube channel for easy digestable content.

Support us at Gitcoin

You've something to share with the blockchain community, join us on Discord!